Interest only mortgage calculator with additional payments

Imagine a 500000 mortgage with a. Interest rates in the calculator are for educational purposes only and your interest rate may differ.

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023.

. A 30-year fixed-rate mortgage is the traditional loan choice for most homebuyers. This Mortgage Qualifying Calculator also summarizes all your information in a detailed report including an amortization table for easy reference. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

There are a few types of home loans that qualify for the mortgage interest tax deduction. An interest only mortgage is one in which the borrower only has to pay off the interest that accrues on the money that is borrowed. Mortgage calculator - calculate payments see amortization and compare loans.

Unsure how your payments may change as rates rise and fall. The Mortgage Qualifying Calculator is designed to be easy to use and largely self-explanatory. LA IR 12 ITMP.

While the typical loan is a mortgage a home equity loan line of credit or second mortgage may also qualifyYou can also use the mortgage interest deduction after refinancing your homeJust make sure the loan. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

In most loans compounding occurs monthly. Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term.

Once you click compute youll see how much the extra mortgage payments will save in the way of interest over the life of the loan and also how much faster youll pay off your mortgage. There are innumerable expenses. P Principal Amount initial loan balance i Interest Rate.

You can view current VA mortgage rates here. You can also see the savings from prepaying your mortgage using 3 different methods. With a semi-monthly mortgage payment your mortgage payment will be made two times per month.

The final word Ultimately mortgage calculators ensure that borrowers are more informed when it comes to the financial side of purchasing a home and enable home buyers to make the choices that are. Additional loan options are listed in the drop down filter area. It also generates a printable amortisation schedule of your monthly mortgage payments.

A loan term is the duration of the loan given that required minimum payments are made each. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Anyone who has ever owned a home understands that the tightest year from a financial perspective is the first one.

We provide a UK mortgage amortisation calculator. Using the Mortgage Qualifying Calculator. You can compare interest-only payments and fixed-rate loans side by side.

The Math Behind Our Mortgage Calculator. Use our free mortgage calculator to estimate your monthly mortgage payments. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months.

Generally the more frequently compounding occurs the higher the total amount due on the loan. Looking for an interest-only mortgage calculator. Todays national mortgage rate trends.

Semi-monthly mortgage payments are not the same as bi-weekly mortgage payments. Our interest only guide will help you estimate your interest only mortgage payments. Interest-Only Loans Are Great When Money Is Tight.

For example you might make a payment on the 1st of the month and another payment on the 15th of the month. Because only the interest is being paid the interest payments remain fairly constant throughout the term of the mortgage. N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage.

M Monthly Payment. Some second mortgage loans are only 10 percent of the selling price requiring you to come up with the other 10 percent as a down payment. Whatever the frequency your future self will thank you.

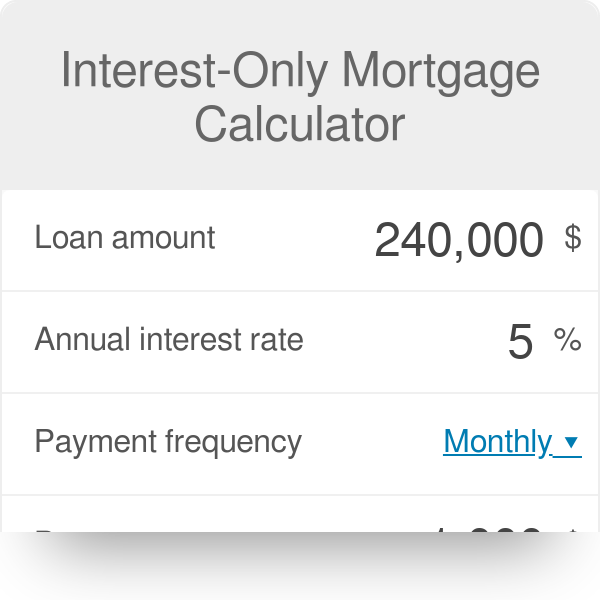

In this scenario you take out a primary mortgage for 80 percent of the selling price then take out a second mortgage loan for 20 percent of the selling price. Building a Safety Buffer by Making Extra Payments. This tool helps buyers calculate current interest-only payments but most interest-only loans are adjustable rate mortgages.

Required Income This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. Semi-monthly mortgage payments split every month into two. The calculator works.

Interest rates typically vary based on several factors including credit score. Make more frequent payments. Because interest payments on your primary residence are tax-deductible for loans up to 750000 100 percent of your interest-only mortgage is tax-deductible if you itemize.

According to Figure 1 this means that type0 the default for the FV functionIf I wanted to deposit 1000 at the beginning of each year for 5 years the FV function in Excel allows me to calculate the result as FV45-10001 where type1Just remember that. However interest-only mortgages do not last forever. Required Income Calculator for a Mortgage Calculator.

You need to be aware that an interest-only loan presents some additional risk compared with a conventional fixed. Just fill in the various fields with the information requested. This allows you to see how changing rates can impact your monthly payments.

Mortgage calculators can help you to include these additional factors when youre determining the necessary monthly payments for your new home. To figure out your interest-only payments simply follow this formula. For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations.

Sometimes these loans are called 80-10-10 loans. For today Tuesday September 06 2022 the current average rate for the benchmark 30-year fixed mortgage is 605 up 16 basis points since the same time. Account for interest rates and break down payments in an easy to use amortization schedule.

Note These formulas assume that the deposits payments are made at the end of each compound period. Loan term is the length you wish to borrow - typically 15 or 30 years. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. Use the Compound Interest Calculator to learn more about or do calculations involving compound interest. Early Mortgage Payoff Examples.

Now that you understand the potential difference in monthly charges for an interest-only loan here is the main reason why you should consider one. These include a home loan to buy build or improve your home. To use our mortgage calculator slide the adjusters to fit your financial situation.

Paying an Interest-Only Mortgage.

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Loan Repayment Calculator

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Interest Only Mortgage Calculator

Free Interest Only Loan Calculator For Excel

Balloon Loan Calculator Single Or Multiple Extra Payments

Loan Calculator With Extra Payments Mycalculators Com

Interest Only Loan Calculator Simple Easy To Use

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Extra Payment Mortgage Calculator For Excel

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed